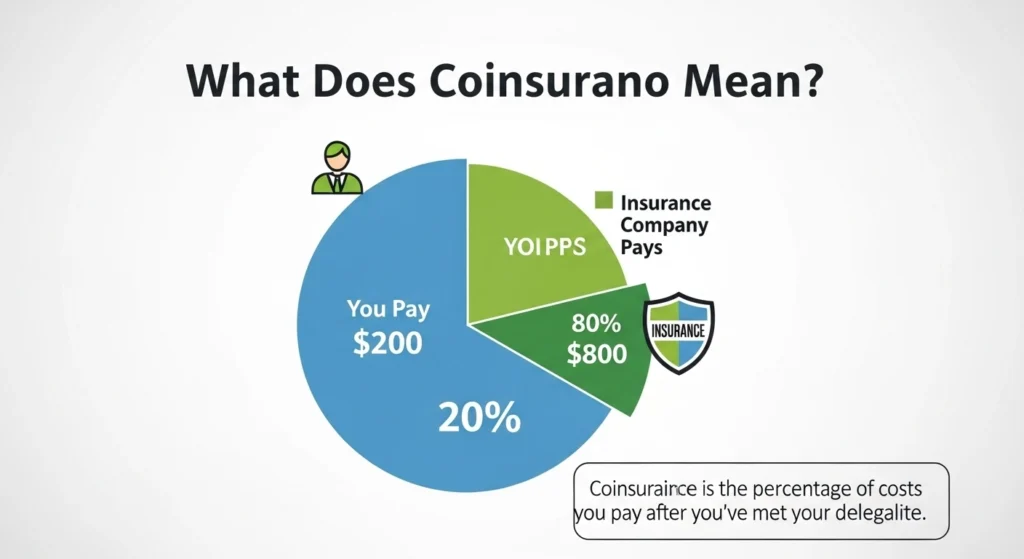

In recent years, coinsurance has become a hot topic, especially as healthcare costs rise and people search for ways to manage medical expenses. Many are confused about what it actually means and how it affects their insurance bills. Coinsurance is the percentage of a medical bill that you, the policyholder, are responsible for paying after meeting your deductible. Unlike copayments, which are fixed amounts, coinsurance is a share of the cost, making it essential to understand for budgeting and avoiding surprises.

Quick Answer

Coinsurance is the percentage of medical costs you pay after your insurance deductible is met. For example, if your plan has 20% coinsurance, you pay 20% of the bill while your insurer covers 80%.

Understanding Coinsurance in Different Contexts

In Texting and Messaging

While coinsurance is primarily an insurance term, it rarely appears in casual texting. People might reference it when discussing health bills or sharing advice about insurance. For example:

- “I had surgery, and my coinsurance was 20%. I had to pay $400 out of pocket.”

- “Make sure you check your coinsurance before visiting a specialist.”

Here, it simply refers to the financial responsibility split between the insured and the insurer.

In Love and Relationships

Coinsurance doesn’t have a direct romantic meaning, but understanding financial terms like it can impact relationships. Couples who manage healthcare costs together often discuss coinsurance to plan budgets and share expenses.

Example:

- “We need to consider our coinsurance before choosing this health plan for both of us.”

In Slang and Casual Language

In casual or slang contexts, coinsurance is almost never used as a metaphor. If someone mentions it informally, they usually mean “sharing costs” or “splitting bills”, sometimes jokingly:

- “We’re like coinsurance on this brunch—50/50!”

On Social Media Platforms (TikTok, Instagram, Snapchat)

On platforms like TikTok or Instagram, coinsurance trends mainly in healthcare advice content. Influencers and content creators explain insurance terms to help followers avoid overspending. Example captions:

- “Don’t forget your coinsurance! Knowing it could save you hundreds 💸 #HealthTips #Insurance101”

- “Coinsurance vs copay: what’s the difference? Let’s break it down 👀 #MoneyTalks”

Spiritual or Symbolic Meaning

Coinsurance does not have a spiritual or symbolic meaning. It is strictly a financial and insurance-related term.

Numerology or Cultural Meaning

There is no numerology or cultural significance associated with coinsurance. Its importance lies entirely in health insurance and financial planning.

Examples & Usage

Here are practical examples to illustrate coinsurance:

| Scenario | Total Bill | Deductible Met? | Coinsurance % | Amount You Pay | Insurance Pays |

| Doctor visit | $500 | Yes | 20% | $100 | $400 |

| Surgery | $5,000 | Yes | 10% | $500 | $4,500 |

Context matters:

- After meeting your deductible, coinsurance applies.

- Before the deductible, you pay the full bill.

Sample text usage:

- “I met my deductible, now my coinsurance for this visit is only $50.”

- “Make sure to check your coinsurance before scheduling that MRI.”

Common Questions About Coinsurance

What does coinsurance really mean?

Coinsurance is your share of medical costs after the deductible, expressed as a percentage of the bill.

Is coinsurance positive or negative?

It’s neutral, but it can feel negative because it increases your out-of-pocket expenses.

Is coinsurance romantic?

No, it has no romantic meaning. It is strictly financial.

How should someone reply if coinsurance is mentioned?

You can respond by acknowledging the percentage or planning your payment:

- “Got it, I’ll budget for that 20% coinsurance.”

Conclusion

In simple terms, coinsurance is the percentage of medical costs you pay after your deductible. Understanding it helps you plan for healthcare expenses and avoid surprises. Whether you’re reviewing insurance plans, budgeting with a partner, or checking your medical bills, knowing coinsurance ensures you’re financially prepared.